Institutional Insights: Goldman Sachs Global FX Trader 19/1/26

Our Perspectives on USD, JPY & GBP

USD:

As we enter 2026, the US Dollar faces a mixed outlook. Our economists remain significantly above consensus on US growth forecasts for the year, as well as optimistic on China’s GDP growth. Meanwhile, we anticipate moderation in US and European inflation alongside a sluggish labor market, keeping the Federal Reserve in easing mode. This environment suggests modest and mixed foreign exchange (FX) movements, with the Dollar likely trending slightly lower due to its countercyclical nature and the gradual erosion of its overvaluation amid more balanced global asset market returns.

Risks remain twofold:

1. While the Dollar tends to weaken during periods of strong global growth, much of our optimistic outlook stems from the US itself, setting a high competitive bar for other economies.

2. However, as seen last year, the Dollar can depreciate sharply if disruptive policy changes occur or if US returns appear less exceptional.

While we expect limited directional trends for the Dollar in the short term, there are several investable FX themes to consider:

- Emerging Market (EM) Carry Trades: EM currencies such as BRL and TRY are expected to perform well, though the environment may be less favorable than the stellar second half of 2025. Investors should consider reallocating some risk into currencies like ZAR, which offers a blend of carry yield and cyclical exposure.

- Late-Cycle Dynamics: Upside growth surprises could lead markets to price in a higher probability of rate hikes that disrupt equity performance. High-beta G10 currencies (AUD, NZD, SEK, and NOK) are more vulnerable to these risks and may serve as better expressions of this theme than EM currencies.

- Cyclical Drivers Over Rate Divergence: With minimal rate divergence expected, factors such as global risk sentiment and commodity exposure will likely play a larger role in determining relative FX returns.

- Diversifying G10 Funding: A rangebound Dollar makes it prudent for investors to diversify G10 funding sources, which has already influenced most G10 FX moves in early 2026.

- China’s Growth Impact: China’s bifurcated growth trajectory should support a stronger currency over time, slightly outperforming forwards, which could help stabilize other regional currencies.

- Tactical Opportunities in JPY and KRW: Idiosyncratic domestic developments in Japan and South Korea present tactical, tradeable opportunities at opposite ends of the risk spectrum.

In summary, while the Dollar’s direction remains uncertain in the near term, these themes provide a roadmap for navigating the FX landscape in 2026.

JPY: The Case for Selective JPY Funding. The Japanese Yen has been one of the worst-performing currencies year-to-date, bolstering its appeal as a funding currency for many investors. While we have argued that near-term risks are skewed towards further weakness, we believe its longer-term outlook as a funding currency is more uncertain due to two-way risks tied to fiscal and macroeconomic factors. Additionally, we anticipate slightly more supportive portfolio flows, though these are unlikely to play a dominant role in driving the Yen this year under our baseline scenario.

We continue to see potential for tactical JPY underperformance on cross-pair trades if incoming data align with our procyclical baseline or if the anticipated early Lower House election, likely on February 8, delivers a stronger majority for the ruling coalition. Historically, significant steepening in the 2s30s curve, driven by rising fiscal risks, has coincided with a 3-4% upside in USD/JPY, roughly in line with this year’s movements. However, we favor more defensive strategies, such as long EUR/JPY, given the downside risks we foresee in the US labor market and Treasury yields, as well as the heightened risk of intervention.

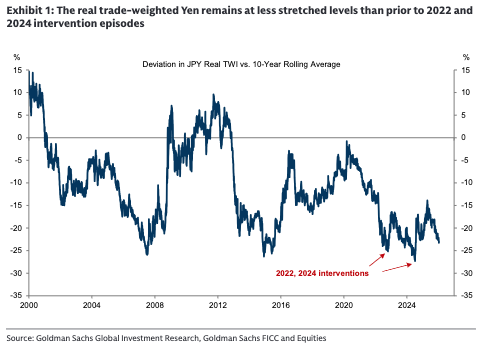

As shown in Exhibit 1, JPY has not yet reached the same level of weakness observed before previous interventions. Its underperformance has largely reflected higher fiscal risk premiums rather than unexplained factors, but there is no reason to dismiss the possibility of earlier direct operations. Intervention discussions appear to be gaining momentum, with verbal warnings intensifying—most recently on Friday, when Finance Minister Katayama stated they are “prepared to take decisive action, including all available options.” A “rate check” could be the next step, which has historically preceded actual intervention. For instance, the last reported rate check occurred shortly before the July 2024 operations and similarly in September 2022, about a week before intervention.

Our economists also highlight the possibility of the Bank of Japan (BoJ) raising interest rates sooner than expected if JPY depreciation persists. A proactive rate hike, particularly if accompanied by a clear signal of intent rather than a “one-and-done” approach, would likely be the most effective measure to curb further Yen weakness. Overall, we expect USD/JPY to trade in the 155-160 range in the near term, as the rising likelihood of intervention caps the upside. However, incoming data and election-related risks are likely to contribute to additional JPY weakness.

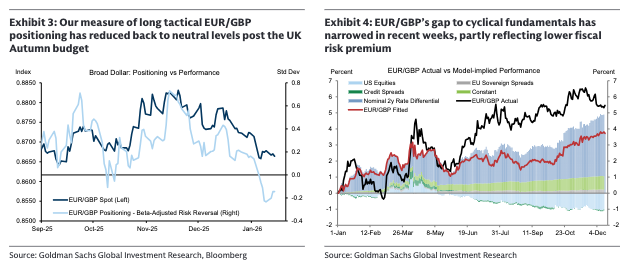

GBP: Analyzing the rebound. We identify three key fundamental drivers behind Sterling's outperformance over the past two months. First, the smooth delivery of the Autumn budget has alleviated concerns surrounding the UK’s fiscal and political landscape, providing sustained relief for the currency. This is evidenced by the continued reduction in fiscal risk premiums post-budget, as seen in the unwinding of long tactical EUR/GBP positions in recent weeks (Exhibit 3) and the narrowing gap between actual and model-implied performance in our GSBEER framework (Exhibit 4).

Second, the Bank of England's careful advice during the December meeting, especially about how there isn't much room for further easing as policy approaches neutral levels, likely reduced any negative feelings about the Sterling related to interest rate differences.

Third, Sterling has gained from a broader risk-on environment that has strengthened various high-beta currencies. Of these factors, we believe the third—Sterling’s exposure to global equities—offers the most enduring support. This exposure creates a significant buffer against domestic economic weaknesses, making it harder for the currency to underperform. Our economists’ baseline forecasts—including substantial disinflation, below-consensus growth, and three additional BoE rate cuts—are expected to meet the threshold for Sterling depreciation, further supported by its clear overvaluation.

Nevertheless, we view shorting Sterling against regional high-beta peers as a more effective strategy for capturing domestic UK trends while minimizing risk exposure. Our ongoing short GBP/SEK recommendation has benefited from SEK’s recent strong performance, which now appears vulnerable to a tactical correction. As such, we are tightening our stop from 12.80 to 12.45 while maintaining our target of 12.10.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!